tax loss harvesting limit

Is there a limit to tax-loss harvesting. First if the long term investor.

Tax Loss Harvesting 2022 John Hancock Investment Mgmt

Any net losses above this can be rolled.

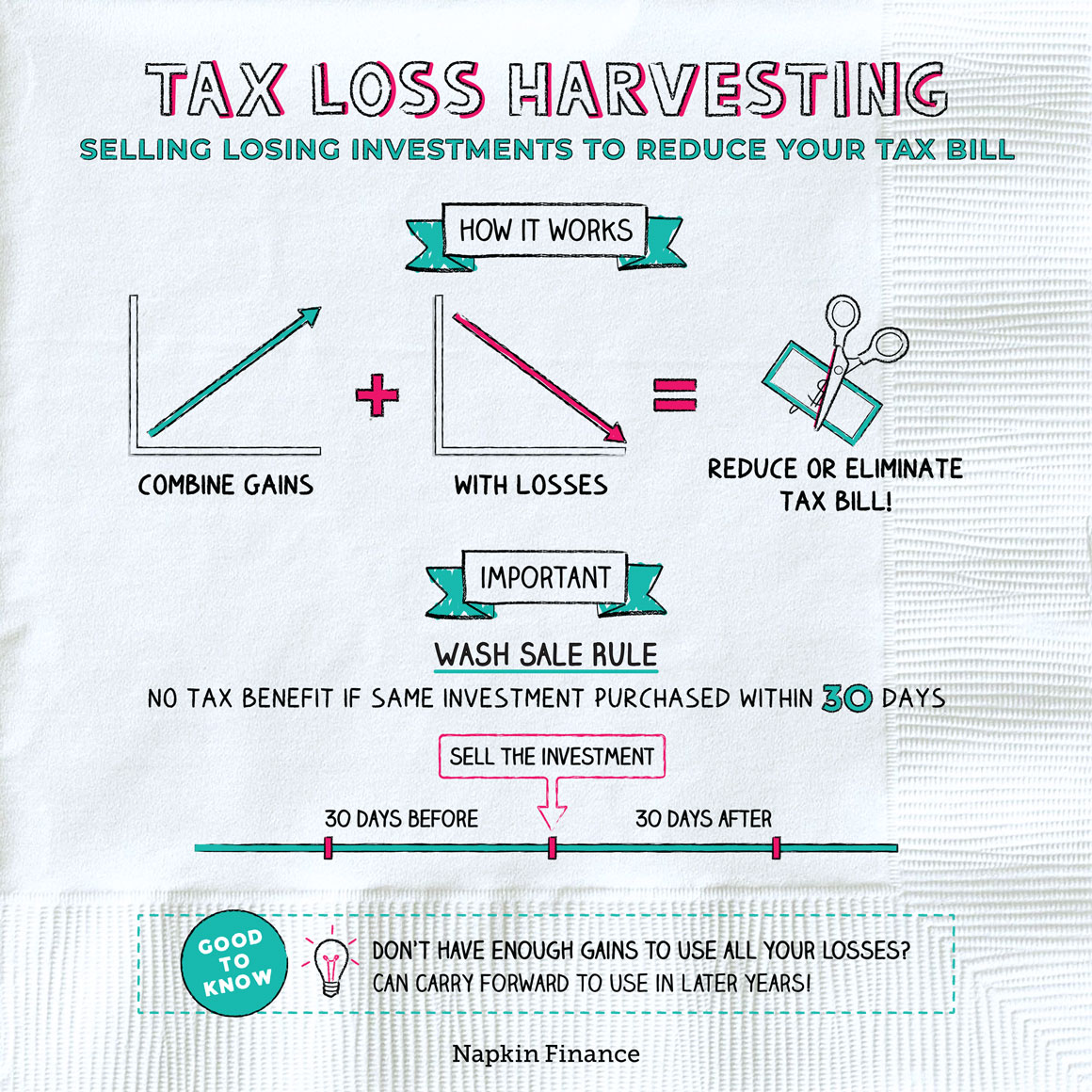

. Is There Any Limit to Tax Loss Harvesting. In addition if your losses are larger than the gains you can use the remaining losses to offset up to 3000 of your ordinary taxable income for married couples filing separately. They may then buy the asset.

3000 per year for individual filers or married. You can harvest as much as you want and offset up to 100 of your capital gains. Tax gain harvesting takes advantage of the low tax rates for long-term capital gains.

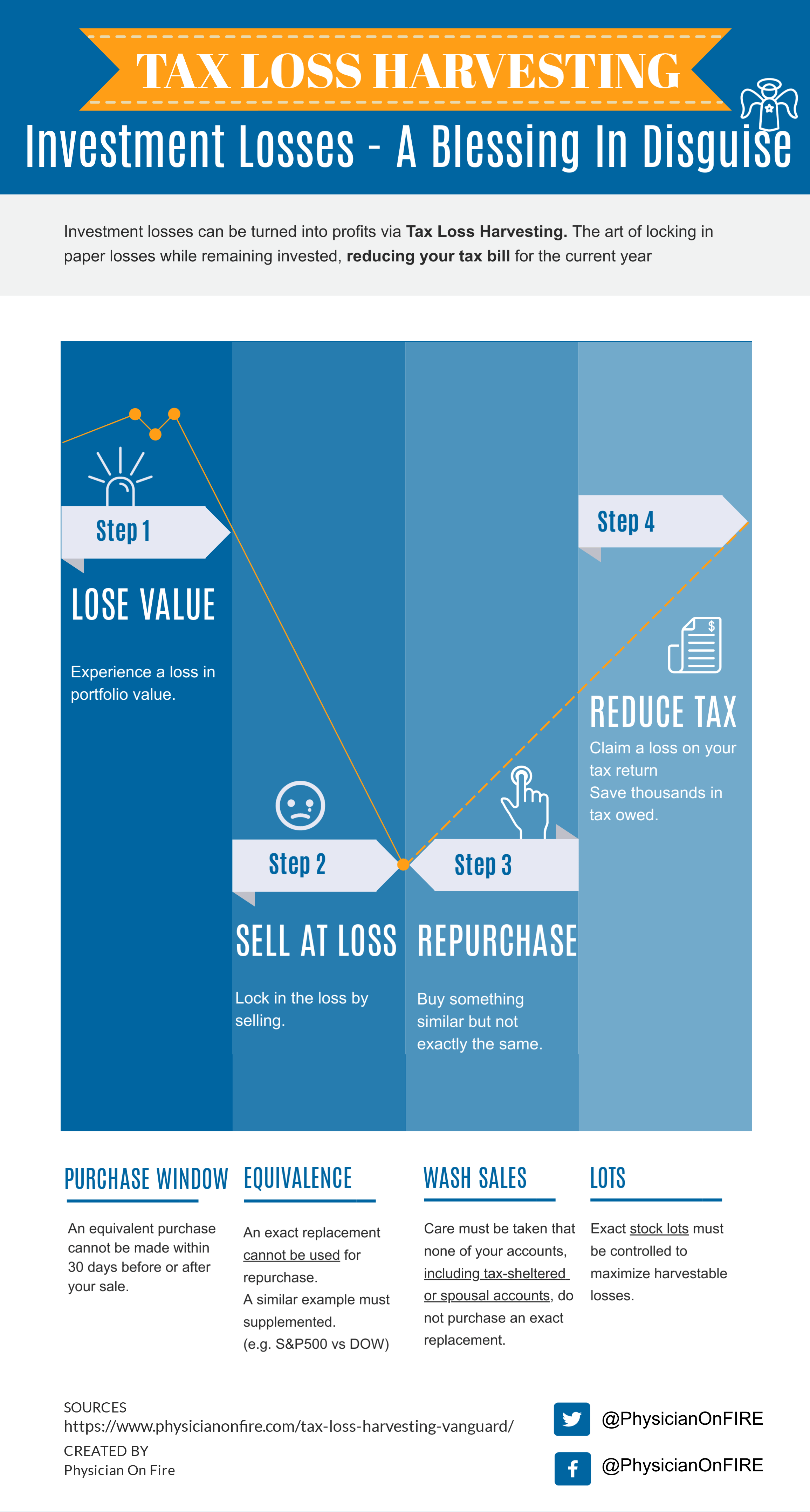

In order to qualify for these lower taxes you must own the asset for at least one year. Crypto tax loss harvesting is when an investor sells crypto at a loss to create a capital loss to offset it against their capital gains and reduce their overall tax bill. Unfortunately there are some limits and rules to abide by.

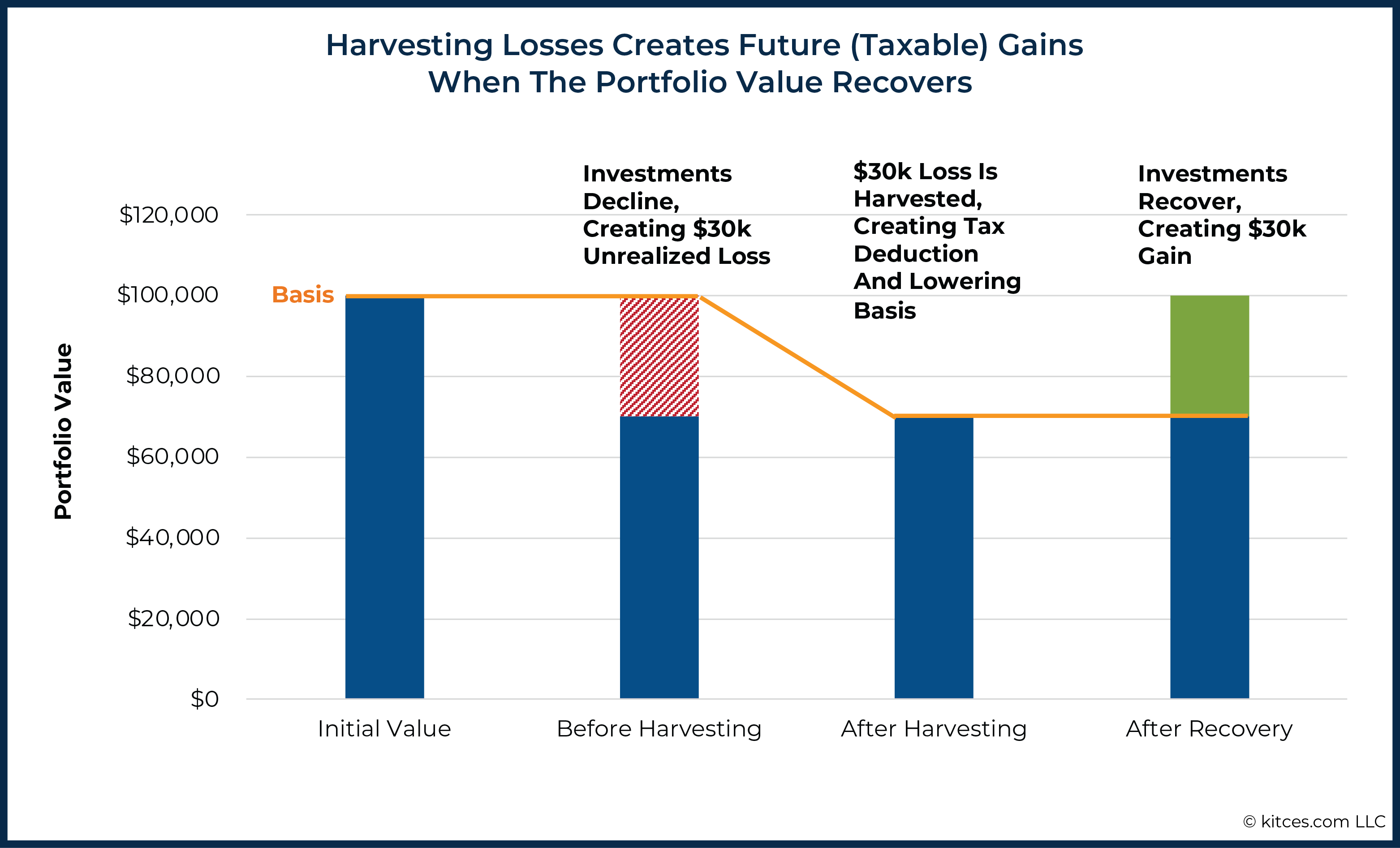

So far tax loss harvesting sounds like a great way to reduce ones tax liability. There is no limit on how much loss you can harvest. Tax-loss harvesting refers to selling an asset at a loss to offset the gains on the sale or sales of other investments.

There is no limit to the amount of investment gains that can be offset with tax-loss harvesting. A tax loss strategy for advisors looking for investment opportunities within equities for their clients is to move into the Nationwide. Tax-loss harvesting can be used to offset 100 of capital gains for the year and up to 3000 of personal income.

If you sell it before. Tax-loss harvesting is valuable only in taxable accounts not special tax-advantaged accounts such as IRAs and 401ks where capital gains arent taxed annually or sometimes at. You may work with a client on tax-loss harvesting when youre.

However there are limits to the amount of taxes on ordinary income that can be. As mentioned above theres a limit to how much you can reduce your ordinary income each year through tax-loss harvesting. Tax Loss Harvesting Small-Caps With NTKI.

The remaining long-term capital loss is 4000 which can be carried forward to the next tax year to offset capital gains and ordinary income up to the 3000 limit.

How Tax Loss Harvesting Can Reduce Your Tax Bill Personal Capital

Watch Out For Wash Sales Charles Schwab

Tax Loss Harvesting John Hancock Investment Management

10 Things To Know About Tax Loss Harvesting Gobankingrates

5 Things To Know About Tax Loss Harvesting

5 Situations To Consider Tax Loss Harvesting Turbotax Tax Tips Videos

Is Automated Tax Loss Harvesting A Good Idea Sofi

When Not To Use Tax Loss Harvesting During Market Downturns

.jpg)

The Ultimate Guide To Cryptocurrency Tax Loss Harvesting Coinledger

Top 5 Tax Loss Harvesting Tips Physician On Fire

What Is Tax Loss Harvesting Forbes Advisor

Tax Loss Harvesting How To Make The Most Out Of Market Volatility Warren Street Wealth Advisors

Tax Loss Harvesting Napkin Finance

Tax Loss Harvesting Definition Rules Examples Seeking Alpha

Weighing The Pros And Cons Of Annual Tax Loss Harvesting

Tax Loss Harvesting What Is It Can It Help Lower Taxes

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Tax Loss Harvesting Turns Losses Into Gains Here S When To Skip It

.jpg)

The Ultimate Guide To Cryptocurrency Tax Loss Harvesting Coinledger